The more important reason for the somewhat ambiguous explanations has to do with the fact that technical analysis is more of an art than a science. You should not expect rigid rules with most forms of technical analysis - just guideposts.

Steve Nison "Japanese candlestick charting techniques"

Market analysis with the help of Japanese candlesticks allows you to determine the trend and find entry/exit points. Moreover, a large number of different entry models will satisfy even a seasoned and experienced trader.

In this article, we will consider two differently directed combinations of Japanese candlesticks, which are not so popular on the market. However, they are characterized by a high degree of refinement and profitability.

Combination for sale: Dark Сloud Сover

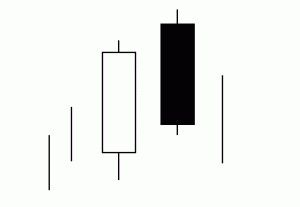

Dark-cloud consist of only two candlesticks, and can signal both a reversal pattern and a continued bearish trend. The first candle should be white, the second - black. The high of the black candle must be higher than the high of the white one. However, the close of the black candle occurs below or around the midpoint of the white one.

The combination should ideally be as follows:

You can enter the market right with the opening of the next candle after the formation of the pattern, but it would be better to wait for a confirmed downtrend.

"Dark Сloud Сover" for Forex

Place a "stop" at entering the black candlestick's high, a "take-profit" - at a level three times higher than the above-mentioned high, or close the position by market when a buy signal appears. Consider the fact, that this combination signals the trend change: the higher timeframe where the pattern has formed, the more profit you can get.

Combination for buy: Piercing line

It is the exact opposite in this pattern. The first candlestick in the combination is long and black, the second - white. Its open starts below or at a level where the black candle closes, and its close occurs at the midpoint of the first one.

You can enter the market right after the formation of the pattern. Place a "stop" after the white candlestick's low, a "take-profit" - at a level three times higher than a "stop-loss". You may also accompany the position until the formation of the combination for buy and exit the market.

Combinations "Dark Cloud Cover" and "Piercing Line" are not so popular on the market, but their formation in most cases signals the change of the medium- and long-term market. They can be used for both intraday trading (timeframe for the entry: h1-h4) and common analysis of currency pairs.